VAT receipts for end customers

1) How do I generate a VAT receipts for my customer?

2) What are the Trading Details displayed?

3) How do I update my company Trading Details?

4) Customers receipt is showing the wrong VAT

1) How do I generate a VAT receipts for my customer?

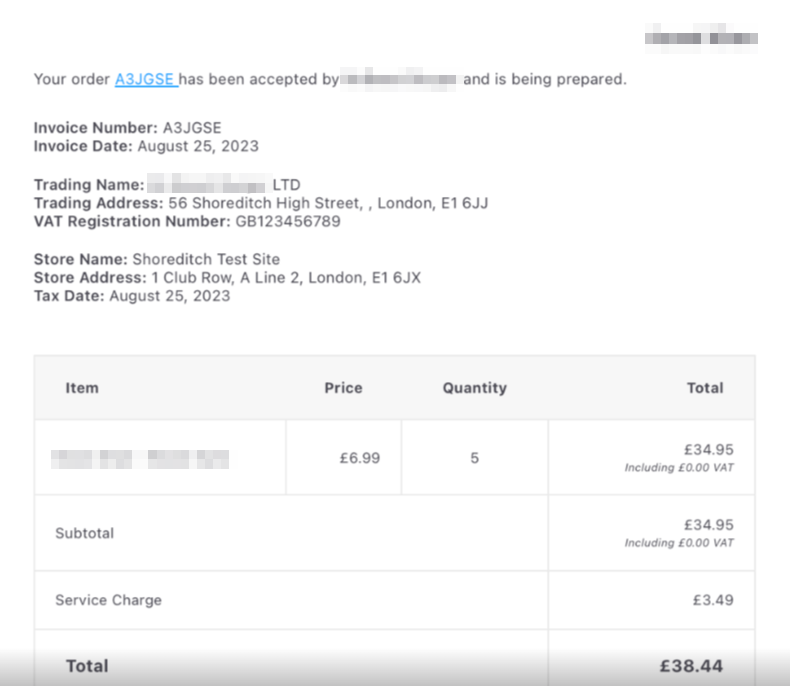

The VAT receipt is automatically sent to your customers via email when you process and accept their order. This email can not be generated manually. The "Order Accepted" confirmation email contains your business VAT information, allowing the customer to use the email as a VAT receipt, as in the example below.

What are the Trading Details displayed?

The details below are automatically generated at order creation:

- The Invoice Number (Order ID)

- Invoice Date (Date order is placed)

- Store Name

- Store Address

- Tax Date (Date order is fulfilled)

The details below are retrieved from the Company Trading Details found on your Slerp Controls Administration Page.

- Company Name

- Company Trading Address

- VAT Registration Number

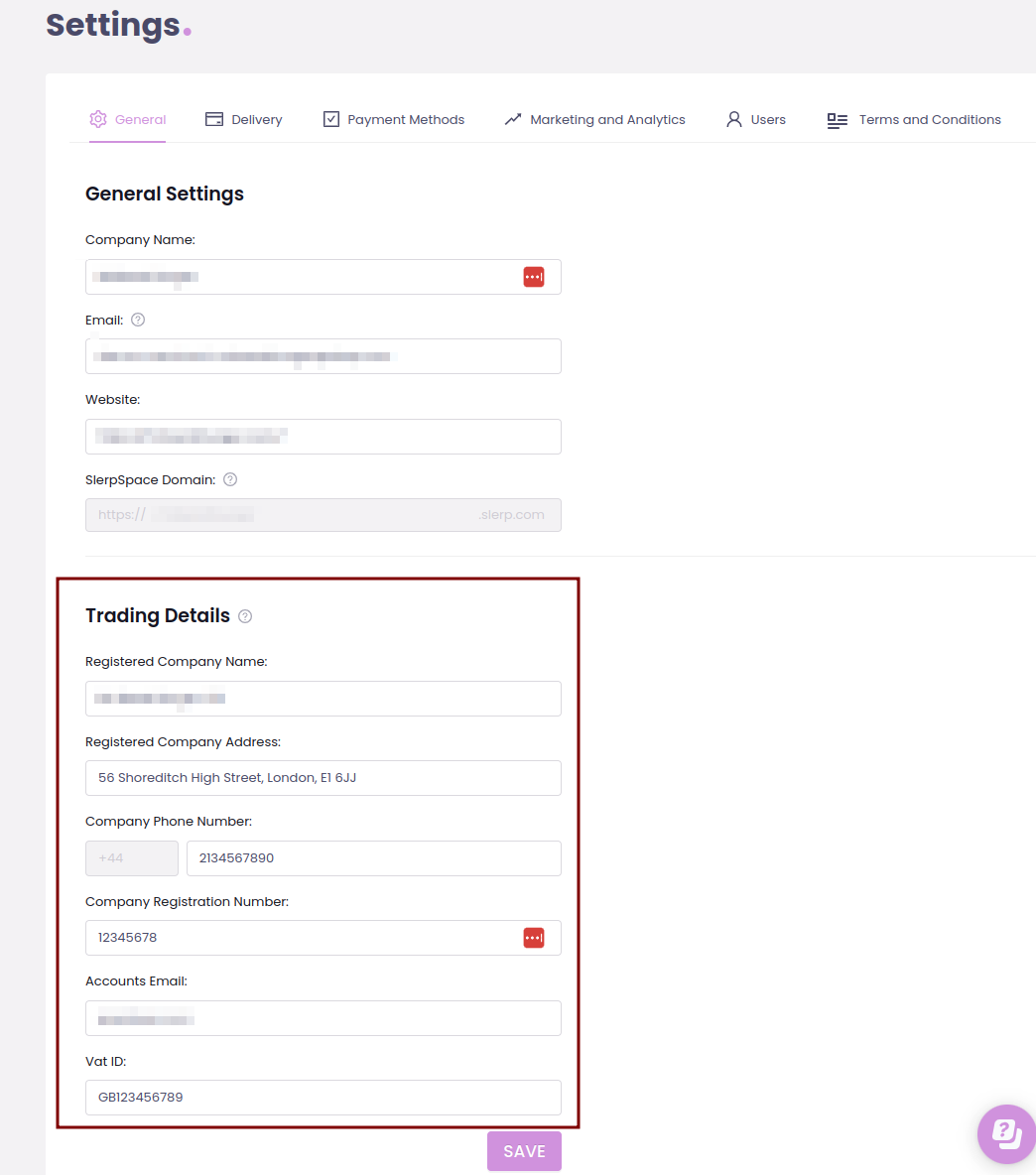

How do I update my company Trading Details?

1) Log into your Slerp controls and navigate to your Settings page.

2) Find the Trading Details under the General Settings tab.

3) Please ensure that all trading information is provided and accurate as this is used to provide a valid receipt to your customer and hit save.

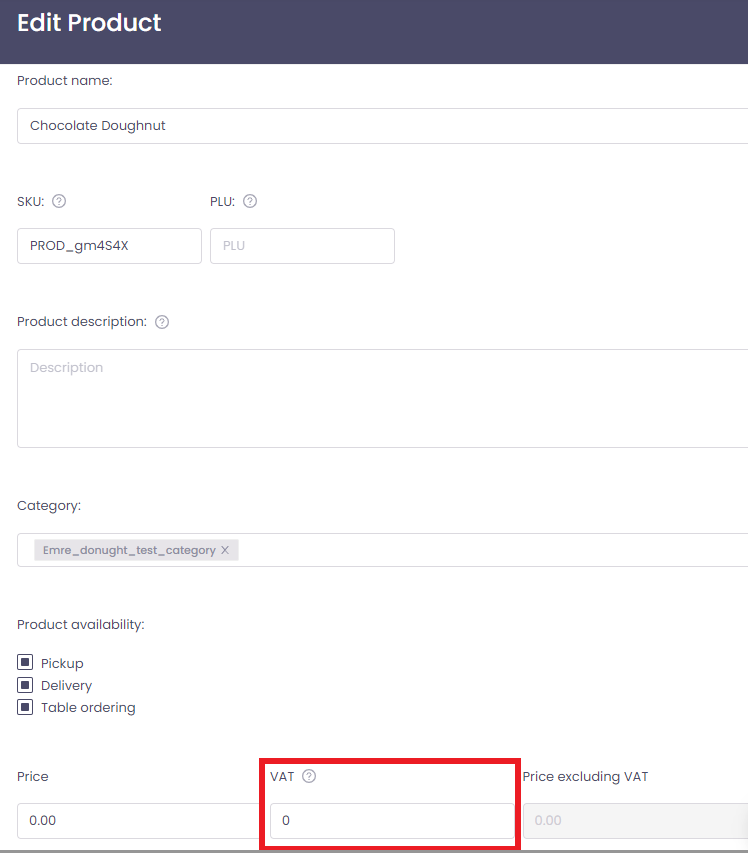

4) Customers receipt is showing the wrong VAT value

The VAT showing in the confirmation email is retrieved from the menu items set in your Slerp controls. If you'd like to update the VAT value of your menu, please click here.